As Ed Conway noted in The Times recently, Mark Zuckerberg once observed that “in a lot of ways, Facebook is more like a government than a traditional company”. Indeed it is. And in fact it just got a lot more like a government. Companies have loyalty points, but governments have currencies, which are like loyalty points but with standing armies. You can hardly have failed to notice that Mr. Zuckerberg’s highly successful advertising company Facebook is now planning to have a currency of its own.

The currency is called Libra and the media has been full of commentary about it the new blockchain that will support it (created by the Libra Network) and the new wallets that it will be stored in (created by Calibra, a Facebook subsidiary). Whatever you think about Facebook, or social media in general, or Bitcoin and its ilk, there’s no getting around that this is a big deal and it was unsurprising that it attracted such wide media coverage.

Now, putting to one side whether it is a currency or not or a blockchain or not (Central Banking magazine said that it’s “neither a true currency nor bearing all the hallmarks of a typical crypto asset, Libra will run on a system similar to a blockchain”) and actually I kind of agree with the economist Taylor Nelms that “the crypto angle does seem like a sideshow”, the fact that it exists is nonetheless rather interesting, although not necessarily for reasons that are anything to do with money although it is a payment system of a potentially large scale, as I will explain later.

What is the purpose of this new payment system though? Libra says that hope to offer services such as “paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass”. But as numerous internet commentators have pointed out, if you live in London or Nairobi or Beijing or Sydney you can already do all of these things. It’s only in San Francisco where such things appear to be special effects from Bladerunner, an incredible vision of a future where people don’t write cheques to pay their rent and can ride the bus without a pocket full of quarters.

Nevertheless, I’ve written before that a Facebook payment system would be beneficial and I stand by that. The ability to send money around on the internet is clearly useful and there are all sorts of new products and services that it might support. A currency, however, has more far reaching implications. As the brilliant J.P. Koenig points out, Libra is more than a means of exchange. The Libra “will be similar to other unit of account baskets like the IMF’s special drawing right (SDR), the Asian Monetary Unit (AMU), or the European Currency Unit (ECU), the predecessor to the euro” in that it is a kind of currency board where each of units is a “cocktail” of other currency units. This should, unlike Bitcoin, provide a reasonably stable currency for international trade.

This has significant implications. What if, for example, the inhabitants of some countries abandon their failing inflationary fiat currency and begin to use Libra instead? The ability of central banks to manage the economy would then surely be subverted and this must have political implication. This has not gone unnoticed by the people who understand such things, an example being Mark Carney, quoted in the Financial Times saying that if Libra does become successful then “it would instantly become systemic and will have to be subject to the highest standards of regulation”. Unsurprisingly, both the international Financial Stability Board and the UK’s Financial Conduct Authority have said they will not allow the world’s largest social network to launch its planned digital currency without “close scrutiny“.

So there are all kinds of reasons to be sceptical about whether Libra will ever launch and whether it will reach any of the goals set out by its founders. And yet…

There’s something interesting in Libra. I’ve long written about the inevitability of new technology being used for new payments systems that will in turn be used to create new forms of money. More than two decades ago I wrote about the advent of private currencies and I covered the nature of corporate currencies more recently (and in some detail) in my book “Before Babylon, Beyond Bitcoin”.

(Although I have to note than in my “5Cs” taxonomy of the future of money, I would classify Libra as a community currency rather than a corporate currency, but that’s not the point of this discussion.)

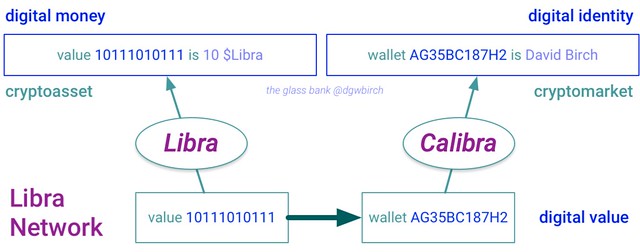

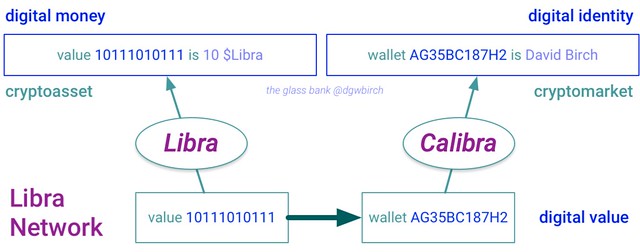

Now, using the model that I set out in the book to help general business readers understand what the likely trajectory of digital assets will be, I look at the two institutional bindings needed to turn the cryptographic level o. These are the binding of values on the ledger to real-world assets and the binding of the wallets to real-word entities.

//embedr.flickr.com/assets/client-code.js

//embedr.flickr.com/assets/client-code.js

The binding of a wallet address to an actual person is difficult and costly. Here’s what Calibra say about it: “Calibra will ensure compliance with AML/CFT requirements and best practices when it comes to identifying Calibra customers (know your customer [KYC] requirements) by taking the following steps

-

Require ID verification (documentary and non-documentary).

-

Conduct due diligence on customers commensurate with their risk profile.

-

Apply the latest technologies and techniques, such as machine learning, to enhance our KYC and AML/CFT program.

-

Report suspicious activity to designated jurisdictional authorities.”

I thought it was worth reproducing this in full. So if we put together what the Libra white paper says with what Calibra say about their wallet, you get this specific version of the model from my book. I think it describes the overall proposition quite well.

//embedr.flickr.com/assets/client-code.js

//embedr.flickr.com/assets/client-code.js

All well and good. Now, while I was reading through the Libra description, I didn’t find anything remarkable. Until the last part. On page nine of the Libra white paper, just at the very end, I notice that “an additional goal of the association is to develop and promote an open identity standard. We believe that a decentralized and portable digital identity is a prerequisite to financial inclusion and competition”.

Well, well. An “open identity standard”. Kevin Weil, Facebook’s VP of product for Calibra was clear that users will have to “submit government-issued ID to buy Libra” as you would expect (people without IDs will still be able to buy Libra through third-party vendors, of course, but that’s a different point.

Put a pin in “government-issued ID” as we’ll come back to it later.

Now, if Calibra provides a standard way to convert a variety of government-issued IDs into a standard, interoperable ID then that will be of great value. Lots of other people (eg, banks) may well want to use the same standard. In the UK, for example, this would be a way to deliver the new Digital Identity Unit (DIU) goal set out by the Minister for Implementation, Oliver Dowden, of one login for your bank and your pension. But it isn’t only the ID that needs interoperability, it’s the credentials that go with it. This is how your build a reputation economy. Your Calibra wallet can store your IS_OVER_18 credential, your Uber rating and your airline loyalty card in such a way as to make them useful. Now, if you want to register for a dating side, you can log in using Calibra and it will automatically either present the relevant credential or tell you how to get it from a Libra partner (eg, MasterCard).

It seems to me that this may, in time, turn out to be the most important aspect of the “Facebucks” (as I cannot resist calling it) initiative. What if a Calibra wallet turns out to be a crucial asset for many of the world’s population not because it contains money but because it contains identity?

Back to that idea of a government-issued ID. If I obtain a Libra wallet by presenting my passport, that’s fine. But suppose I live in a developing country and I have no passport or not formal ID of any kind. Well I think Facebook can make a good argument that your Facebook profile is a more than adequate substitute, especially for the purposes of law enforcement. After all, Facebook knows who I message, my WhatsApp address book, who I hang out with, where I go…

Frankly, in large part of the world Know-Your-Customer (KYC) could be replaced by Known-by-Zuck (KYZ) to the great benefit of society as a whole.