xxx

one in 10 people were refused by shops when trying to pay for items with cash,

From Which? calls on UK Government to prevent collapse of cash:

xxx

A library of snippets

xxx

one in 10 people were refused by shops when trying to pay for items with cash,

From Which? calls on UK Government to prevent collapse of cash:

xxx

xxx

Axa Venture Partners was the lead investor in the $13.5m funding round for D-ID, an Israeli startup developing technology that can mask and blur faces, anonymising images and video.

In an era where Covid-19 is ramping up surveillance, de-identification tech like this will increasingly be in demand,

xxx

xxx

D-ID, which stands for de-identification, is a pretty straightforward service that’s masking some highly involved and very advanced technology to blur digital images so they can’t be cross-referenced to determine someone’s identity.

xxx

A central problem with social media discourse is, in my opinion, the rise of the bots. You can see the magnitude of the problem in the current crisis, where researchers found that bots may account for around half of the Twitter accounts discussing covid-19! Many of those accounts were created quite recently and have been amplifying misinformation, including false medical advice and conspiracy theories about the origin of the virus while pushing to “reopen America”.

The problem is now quite serious. There are vast armies of bots out there trying to spread disinformation, foment division and fracture communities. Elections and the democratic process itself are under attack. It almost makes me nostalgic for the good old days when hackers were just trying to steal credit card numbers instead of trying to interfere with elections!

This came up in my “identity stroll” with Sudan Sethuramalingam, Head of Scaled Operation at Twitter. I was asking him about the threats to online content integrity (and what kind of actions we might take to counter them). He has a background in heavy duty know-your-customer (KYC) and anti-money laundering (AML) with banks as well as social media platforms, so he really understands the magnitude of the problem. We were discussing the complexity of managing social media content and algorithms give the vast scale of the networks and their importance to society.

After listening to him, I reflected that it is probably best to focus on the issue of the bots rather than the content, which seems to me to be impossible to police. If people could just set their social media feeds to ignore content from bots, we might improve the quality of the conversation there significantly. So maybe that’s where we should focus: not trying to flag up contents, but flagging up the users so that social media users can ignore them.

The way forward is surely not for Twitter et al to try and figure out who is a disinformation bot and whether they should be banned (after all, there are plenty of good bots out there) but for Twitter et al to give their users the information they need to make a choice. Why can’t I tell Twitter that I only want to see tweets from real people that can be identified? I don’t want to know the identities — it’s none of my business who a person actually is and it’s none of Twitter’s business either — I just want to know if I’m following a person or not! I know that I’m on the right track here, by the way, because noted entrepreneur Elon Musk agrees with this prescription, having reportedly told Jack Dorsey, the head of Twitter that “I think it would be helpful to differentiate’ between real and fake users… Is this a real person or is this a bot net or a sort of troll army or something like that?”.

If we could just go so far as to tell real people from fake people, we’d be well on the way to solving the problem. Fortunately, this is where INSTINCT can make a difference, so I’m very happy to be here helping Au10tix to launch a product that will make a real difference in the fight against the fake people.

xxx

Users sign up with their existing Facebook account and perhaps a verified phone number as well. Facebook assesses their profile and only allows them in if they meet a threshold of legitimacy, such as having 15 friends or more and having joined Facebook more than a few months ago.

From Facebook’s Anonymous App Could Kill Trolls With Secret Identity | TechCrunch:

xxx

The problem with this is that Facebook knows who you are.

xxx

The United States has hailed Malta’s announcement on May 26 of its seizure of $1.1 billion of counterfeit Libyan currency printed by Joint Stock Company Goznak – a Russian state-owned company.

A statement by the Spokesperson of the US State Department, Morgan Ortagus, said the money was regarded as counterfeit because it was ordered by an illegitimate parallel entity in eastern Libya, referring to pro-Haftar authorities in the eastern region.From US commends Malta’s seizure of Russia-printed counterfeit Libyan currency | The Libya Observer:

xxx

xxx

In the event of a run on the Reserve, they suggest that rather than forcing the Libra Network to convert its securities into cash and incur fire-sale losses, the Libra Network might adopt redemption stays (delays in providing cash) and early redemption haircuts (additional fees for redemption).

From Libra still needs more baking | VOX, CEPR Policy Portal:

xxx

You can imagine the whiteboard session deep inside Facebook that came up with this idea. It was probably called “What if there was something a bit like money, but it was run by us?” in the executive’s calendars, and you can easily see why it was an appealing idea. But it met with some pretty negative reactions from central banks, regulators and many other stakeholders. Visa, MasterCard and PayPal dropped out of the initial group of Libra Network members and things went a bit quiet.

Well, now a new version of the Libra White Paper is out, adding “stablecoins” in national currencies to the original plan for a single Libra currency based on a basket of currencies. Facebook’s Calibra digital wallet is now called “Novi”. So far, so boring. But I notice that the white paper contains an interesting offer from the consortium to the world’s central banks. It says that the consortium hopes that “as central banks develop central bank digital currencies (CBDCs), these CBDCs could be directly integrated with the Libra network, removing the need for Libra Networks to manage the associated Reserves”.

There’s no need for a new SWIFT, Libra is telling them. If a couple of billion people around the world are going to store their digital cash in Facebook wallets, then why build an alternative? You can be NASA, we’ll be Space-X of money. Meanwhile, the Digital Dollar project has launched it’s first

xxx

Now the Libra Association plans to offer her a dollar-linked stablecoin, LibraUSD. This arrangement, where the US resident uses that digital unit in transactions intermediated by her VASP, differs from the wholesale version of a central bank digital currency (CBDC) only in that the Libra Association rather than the Fed would issue and burn the digital units.

The White Paper even moots the possibility, if a CBDC is issued, that the Association could replace the applicable single-currency stablecoin with the CBDC

From Libra still needs more baking | VOX, CEPR Policy Portal:

xxx

Venezuela crops up in talks about Bitcoin all the time. The political instability, I was told, meant that Venezuelans preferred the safety and security of Bitcoin “digital gold” over their own hyperinflated currency or President Maduro’s own cryptocurrency, the “Petro”. This was created in 2017 and is supposedly backed by Venezuela’s vast oil reserves. The President has just sent a whole bunch of Petros to the country’s doctors, although whether medical professionals will hold on to these digital tokens or not it is too soon to tell.

Venezuelans seen less than keen of their version of central bank digital currency, since Petros trade for half their official value on the streets (well, web sites) of Caracas, and I couldn’t help but notice that when Panama-based cryptocurrency merchant-gateway startup Cryptobuyer announced a partnership with Venezuelan company to process cryptocurrency payments for thousands of local businesses, they were quoted as having no plans to support the Petro alongside Bitcoin, Ethereum and all the other favourites.

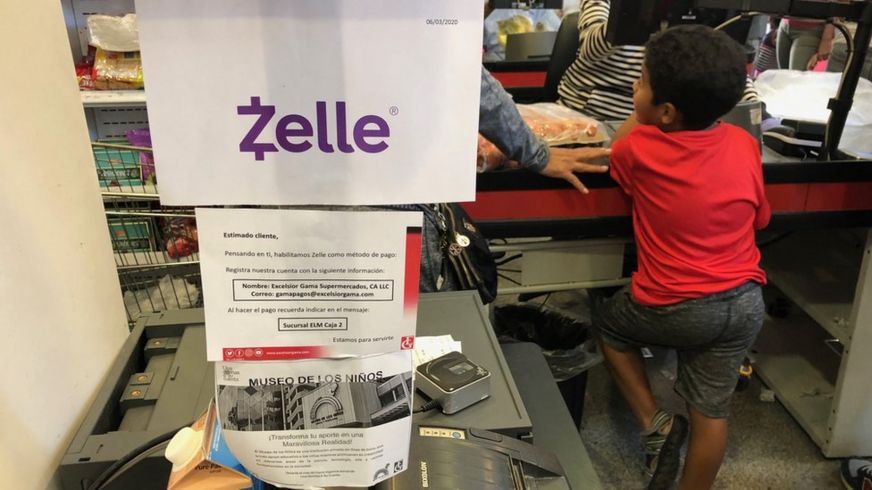

It’s the world’s first Bitcoin economy, then? Well, not really. Restaurants, shops, supermarkets and even the street vendors today accept – and prefer – dollars in cash or by bank transfer. You can pay by Zelle in supermarkets in Venezuela, something I’ve never seen in an American retailer! The sentiment of the streets is unambiguous: they want greenbacks.

Source: BBC.

A Columbian start up, Valiu,has just launched to provide a USD “stablecoin” for the Venezuelan market so perhaps that might eat into the bank transfer market but I wouldn’t bet on it. If anything is going to replace the demand for physical US dollars in the supermarkets of failed states, it is going to be digital US dollars. That’s why, in my opinion, the delivery of a US Central Bank Digital Currency (CBDC) should be a priority. Yes, it might make the US domestic economy more efficient but it’s really much more about maintaining the dollar’s dominant position in the global financial system. It’s important, much more important than it seems at first in a country full of Venmo and Cash and Paypal users.

But who should deliver it?

The Digital Dollar Foundation, led by Chris Giancarlo (former Chairman of the U.S. Commodity Futures Trading Commission, the CFTC), has one idea. They have got together with Accenture to create the “digital dollar project” and have released a White Paper putting forward a suggestion for the US CBDC. They propose what is called a “two tier” CBDC which, as I explain in my recent book “The Currency Cold War”, means that while the Federal Reserve will regulate and control the digital dollar, it will end up in consumers’ pockets (in their mobile phones) through the commercial banks.

There are alternatives to this essentially quite conservative approach, though. What if we look outside the banking system and see what Big Tech can do? In the new version of the Libra’s own White Paper, which adds “stablecoins” in national currencies to the original plan for a single currency (called “Libras”, rather than “Facebucks” as I suggested) based on a basket of currencies, we can see at least one vision for a more radical approach. The white paper says that the consortium hopes “as central banks develop central bank digital currencies (CBDCs), these CBDCs could be directly integrated with the Libra network, removing the need for Libra Networks to manage the associated Reserves”.

There’s no need for a new SWIFT, Libra is telling them, or a new digital dollar to send over it. If a couple of billion people around the world are going to store their digital cash in Facebook wallets (now called “Novi” wallets, rather than “Zucksacks” as I suggested), then why waste money on trying to update or extend the existing banking infrastructure to do the same thing? You can be NASA, they are telling the Federal Reserve, and we’ll be the Space-X of money.

Digital currency is a new space race, and America needs to win it.

xxx

Russia’s largest bank, Sberbank, has called for tenders to provide 4,917 ATMs with a built-in graphic card capable of supporting “blockchain operations”.

From Russia’s Biggest Bank Is Buying 5,000 Blockchain ATMs That Can Mine Crypto:

xxx

There’s a very interesting discussion to be had (and I’m having it in a number of different contexts at the moment) about whether the changes induced by the COVID-19 crisis are short- or long-term and to what extent those changes are an acceleration of existing trends (as I think they are, largely) or new directions for the sector. My good friend Ron Shevlin wrote an excellent piece in Forbes highlighting one element of strategic change, saying that “the new normal marks the end of fintech experimentation”. He goes on to point out, somewhat harshly, that banks have used fintech partnerships as a way of convincing themselves that they are innovating rather than actually doing anything transformational.

I completely agree with Ron. He is generally right about such things anyway, but in this case his informed view illustrates a more general point of my own. I gave some seminars to bank management on the impact of technology on the business a couple of years ago, and to set up a narrative to help the executives frame my approach, I said that I thought the “fintech era” would run through to 2020 when it would be overtaken as the shared paradigm. My prediction, which I stand by, is that we are leaving the fintech era and entering the open banking era. Visa’s multi-billion purchase of Plaid would say that I’m right, I think. The virus may have accelerated the transition between the eras, but it was coming anyway.

In the open banking era, fintechs will not vanish, but they will innovate and operate in a different way. They will not need to partner with incumbents, since they can use open banking infrastructure to get access to their customers’ data that the banks have, and their costs to market should be reduced through the use of standard interfaces. This means that the fintechs will be able to focus on the customer journey and user experience to bring new products and services into the market.

So what, then, should the banks focus on? Well, providing working infrastructure for one thing. I was listening to a techUK webinar on open banking recently and I heard the statistic that 98.5% of API calls on the UK open banking infrastructure are completing. That’s appalling and well below the level of service that is required to offer worthwhile “overlay” services. But as I said in The Economist (“Plug and pay”, 21st November 2019) talking bank products such as loans and mortgages being distributed through a bank sales force, the products are heavily regulated, as they should be, which is why they are unappealing for Big Tech.

And, a terminology break.The techfins are the technology companies who embed financial services to make their own products more attractive but whose business model does not depend on margin in those financial services (as that Economist article noted “Amazon wants payments in-house so users never leave its app”.). The fintechs are companies who embed technology to make their own products more attractive and whose business model depends on margin in those financial services (eg, Transferwise).

The techfins (as opposed to the fintechs) are more than happy to have banks, for example, do the boring, expensive and risky work with all of the compliance headaches that come with it. What Big Tech wants is the distribution side of the business, as shown in this old diagram of mine. They have no legacy infrastructure (eg, branches) so their costs are lower and the provision of financial services will keep customers within their low-cost ecosystems. If you use the Google checking account and Google pay then Google will have a very accurate picture of your finances. A very accurate picture indeed.

The business model here is very clear. What Big Tech wants isn’t your money (the margins on payments are going down) but your data and just as Big Tech has made ecosystems impervious to competition, so it could cross-subsidise (with data as well as with money) its financial services products to raise such a barrier to competition that no newcomer will be able to spend enough to gain traction.

That’s why when people talk about “challengers”, I think they should be talking about Microsoft not Monzo. If Big Tech takes over consumer relationships, banks will end up having to give away margin but, far more seriously, data. As Andrei Brasoveanu of Accel said, if Big Tech gets hold of the distribution side of the financial services business, then the manufacturers of financial services products will be “utilities, providing low-margin financial plumbing”. Well, that’s the lucky ones. The unlucky ones will be wiped out in a wave of consolidation and closures.

[This is an edited version of an article that was first published on Forbes, 26th June 2020.]